Drawdowns and bear markets in the S&P 500 are a normal part of investing. A drawdown refers to a decline in the value of an investment from its peak value, while a bear market is a period where the overall stock market experiences a significant decline.

In this article, we will explore and analyze the characteristics of drawdown and how these findings can help investors to navigate stock market volatility, minimizing the impact of these market downturns on their portfolio and protect their investments during market turmoil. That is why it is important to understand the nature of drawdowns and being prepared in terms of having a plan in place.

There are several strategies that investors can use to minimize their impact.

Unlike traditional buy-and-hold strategies that endure volatility, tactical investing adjusts exposure based on evolving market conditions. The objective isn’t to predict every move—but to stay aligned with the broader trend.

When applied with discipline and backed by robust data, this approach helps reduce major drawdowns while capturing long-term growth. It’s a strategy rooted in consistency and capital preservation—not speculation. However, success requires a clear, research-driven framework.

One effective example is the WSC Long-Term Market Health Indicator. This indicator aggregates dozens of time-tested key metrics – ranging from trend, market breadth, sentiment and the positioning of dumb- and smart money into a single, comprehensive signal.

Rather than relying on subjective judgment or lagging headlines, it gives long-term investors a structured way to assess when markets are healthy enough to be invested and when caution is warranted.

When the indicator is above zero, it means the majority of underlying metrics – such as trend strength, breadth, sentiment, and institutional positioning – are aligned to the upside. In these phases, the strategy favors staying invested to participate in bull market advances.

Tactical investing isn’t about avoiding every dip – but with the right research and tools, it becomes possible to sidestep the most damaging downturns while staying aligned with market strength. It’s a smarter, more adaptive way to invest through uncertainty—grounded in data, not emotion.

Diversification is a key pillar of long-term risk management. By allocating across multiple asset classes a multi-asset portfolio can reduce volatility, limit drawdowns, and provide more consistent returns across market cycles.

Diversification gets increasingly difficult in the “ending market regime of negative correlations”. In particular, traditionally balanced portfolios are currently affected the most and, therefore, might not be sufficiently diversified to act as core investment anymore. One way to address this evolving dynamic is by diversifying not just across asset classes, but also across complementary investment strategies. This approach can enhance portfolio resilience and help deliver more stable returns across a variety of market conditions.

The comparison clearly illustrates the significant spread between the two indicators, showcasing their distinct developments over time

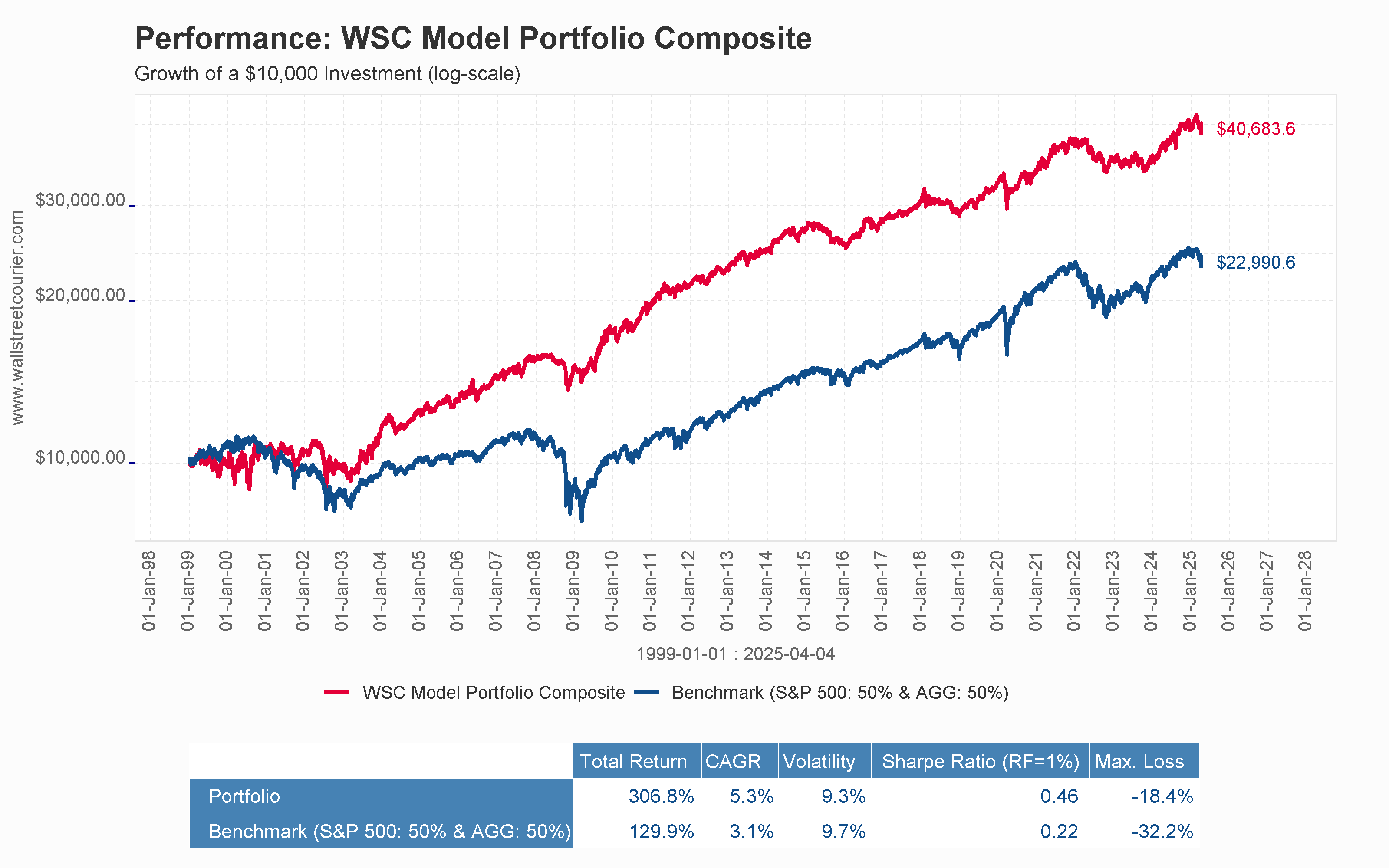

The WSC Model Portfolio Composite is designed to achieve outstanding risk-adjusted returns across all market environments with little correlation to common asset classes by exploiting the diversification premium in a very systematic way.

The buy and hold strategy is often praised for its simplicity and long-term effectiveness. While markets have historically recovered from downturns, the emotional and financial toll of enduring those declines is frequently underestimated.

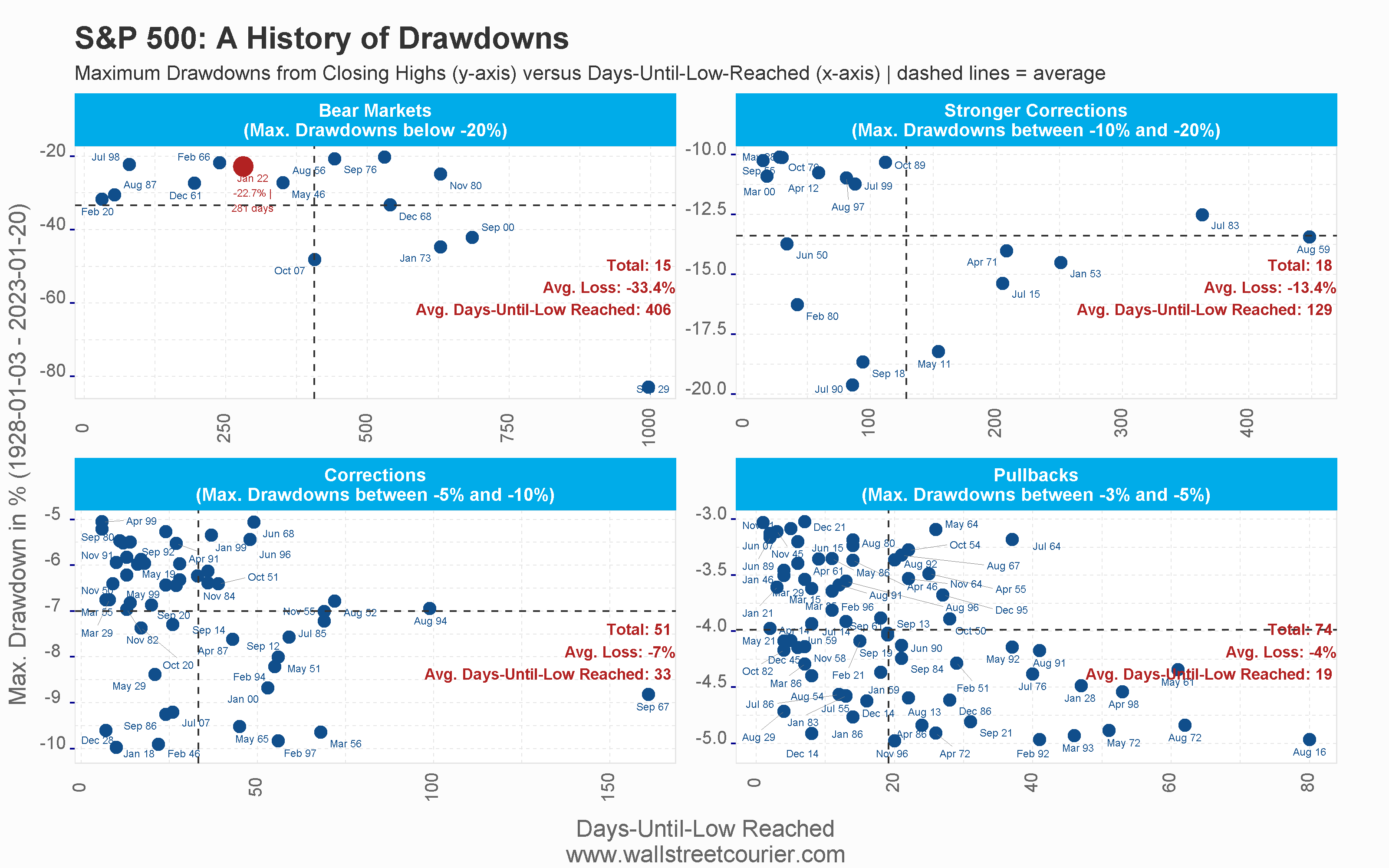

Although most investors can easily recall major stock market crises, significant drawdowns occur more regularly than many expect. To illustrate their frequency and impact, we analyzed S&P 500 drawdowns from 1928 to 2023, classifying them by the magnitude of peak-to-trough losses.

The chart below breaks these events into four levels of severity:

Bear Markets (losses greater than 20%)

Stronger Corrections (losses between 10% and 20%)

Corrections (losses between 5% and 10%)

Pullbacks (losses between 3% and 5%)

In addition to this classification, the chart also highlights the average decline and the average number of days until the final low was reached for each category. This historical context offers a clearer understanding of how frequently these setbacks occur—and why staying invested through them can be more challenging than it seems.

Above you can see the underwater periods from the S&P 500 and major US sectors.

Classifying stock market drawdowns by their severity, this analysis of the S&P 500 index illustrates the frequency and impact of market downturns. The chart categorizes losses into four levels: Bear Markets, Stronger Corrections, Corrections, and Pullbacks, and also includes important data such as the average loss and average time to reach the final low for each category, from 1928 to 2023

Since 1928, the S&P 500 has experienced 15 bear markets – defined as declines of more than 20% from peak to trough. On average, these downturns resulted in a 33.4% loss and lasted 406 days.

The most severe occurred during the Great Depression, with an 82% drop over 996 days. The 2008 Financial Crisis saw a 48% decline in just 407 days, while the dot-com crash (2000–2002) lasted 685 days with a 49% loss. Other prolonged bear markets included 1973–74 and 1980–82, each lasting 629 days.

The fastest drawdown was during the COVID-19 crisis, with a 34% drop in just 32 days. Black Monday in 1987 followed closely, bottoming in 54 days.

Altogether, bear markets accounted for 8,520 days – or roughly 25% of the entire 1928–2023 period.

Since 1928, the S&P 500 has experienced 18 stronger corrections – defined as declines between 10% and 20%. These corrections averaged a 13.4% loss and took 129 days to reach their lows.

The longest occurred from August 1959 to October 1960, lasting 448 days with a 13% drop. The July 1983 correction followed, lasting 363 days with a 12.5% decline.

The fastest correction was in September 1955, reaching its low in just 15 days and recovering to a new high within 34 days. In March 2000, a similar drawdown took 18 days to bottom and 89 days to fully recover.

In total, stronger corrections accounted for 3,286 days—or about 9.4% of the time between 1928 and 2023.

Between 1928 and 2023, the S&P 500 experienced 51 corrections – defined as declines between 5% and 10% from closing highs. These averaged a 7% loss over 33 days. However, this average is skewed by a prolonged correction in 1967 that lasted 161 days; the median time to the low was just 26 days.

Altogether, these drawdowns accounted for 1,701 days, or approximately 4.9% of the total observation period.

Between 1928 and 2023, the S&P 500 experienced 74 pullbacks—defined as declines between 3% and 5% from closing highs. These drawdowns averaged a 4% loss over 19 days. However, most pullbacks occurred within just a few days, as the average is skewed by outliers.

The fastest pullback, a 3% drop, occurred in November 2021 and lasted just one day. The longest began in August 2016, with a 4.9% decline over 80 days.

In total, pullbacks accounted for 1,417 days of market decline, or about 4% of the time during the full observation period.

Managing market volatility requires more than holding on through every downturn. While buy-and-hold can work over time, prolonged drawdowns test both patience and performance. Tactical investing offers a way to reduce downside risk and stay aligned with stronger market phases – provided it’s grounded in disciplined, data-driven research.

Likewise, diversification remains essential, but traditional approaches may no longer offer sufficient protection in today’s shifting market environment.

WSC’s research helps investors navigate these challenges with clarity and structure. Combined with our model portfolios, it offers a practical foundation to manage risk and pursue more consistent returns—across all market conditions.

Behind WallStreetCourier

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

What we provide

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

What we provide

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

You are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information